Working remotely, pet owners continue to spend greater time with their pets, treating them as family members and searching for more premium products. The COVID-19 pandemic has meant that pet owners have embraced the convenience of online shopping and developed new purchasing habits which has contributed to the dynamic growth of e-commerce. The health and wellness trend is expanding from food to pet care, while the role of functional and natural ingredients is significantly increasing. Meanwhile, sustainability drives plant-based options and alternative protein, as well as development of recyclable packaging.

The positive impact that the pandemic has had on demand for pet care only served to reinforce major market trends, which will continue driving up sales in the short term: namely, humanisation, premiumisation, health and wellness, sustainability, and digitalisation.

New levels reached in pet humanisation

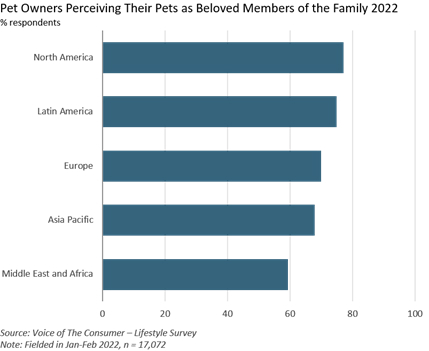

Due to remote working, pet owners have been spending greater time with their pets and increasingly perceive them as part of the family, trying to provide them with products and services they would choose for themselves. According to Euromonitor International’s Voice of the Consumer: Lifestyle Survey, globally, 71% of pet owners consider their pets as family members and their number is strongly increasing in developing markets. Legislative changes in Western Europe in favour of greater pet rights will further influence the perception of pets. For example, in 2022, Spain introduced shared custody of pets for couples following separation or divorce.

Treating their pets similarly to children, consumers are searching for treats which are close to human grade, encouraging producers to launch treats in new formats of popular sweets and savoury snacks. For example, in 2021, German producer Trixie extended its variety of treats in the form of lollipops, pretzels, cookies, waffles and doughnuts. Meanwhile, luxury fashion brands are entering pet care, launching clothes, accessories, and toys for pets. Italian online shop Luxpets, launched in 2021, offers exclusive accessories from the most coveted brands in addition to personalised services.

Premiumisation: Perception of product freshness increasingly relevant

Humanising pets, owners are increasingly eager to provide them with high-quality, expensive food and products. As consumers are searching for specific benefits from the products they purchase, brand owners are expanding their premium offer with the aim of achieving higher margins. The increasing popularity of small dogs also contributes to the market growth, raising the average price, as small breeds consume less in volume terms. Private label traditionally focused on economy and mid-priced products is starting to develop premium offerings, competing with international market leaders through lower prices. Traditionally, private label does not have a significant presence in pet care, and premiumisation is a key tool for retailers’ private label lines to gain share from brands. This is especially relevant in the context of toughening economic conditions.

Premiumisation is driving wet food growth in developing markets, particularly evident in Southeast Asia, and frozen varieties as well as therapeutic premium pet food in mature regions. Fresh food is also gaining momentum alongside frozen, particularly in the US, but its presence is also expanding in other markets. For example, Taiwanese company Just Kitchen launched home delivery of freshly cooked pet food made in a ghost kitchen in 2021. While premiumisation can contribute to future market growth, this will be mitigated by the inflation caused in part by the war in Ukraine.

Pet wellbeing through functional food ingredients

Increasing demand for functional and natural ingredients is expanding from packaged food to pet care. A shift from general wellbeing to specific functionality drives ingredients that address digestive, joint, heart, dental and skin health, as well as mental wellbeing. In 2021, Hill’s Pet Nutrition developed a specific kibble formula and processing method to improve pets’ dental health, while Nestlé continues to expand with its fortified croquettes that support digestive health. Probiotics and hypoallergenic ingredients, and fortified superfoods are experiencing increasing demand. Minerals and botanicals are also gaining interest; for example, the Thai Lifemate premium brand, which was introduced in 2021, offers pet food that contains ingredients for improving skin and hair, as well as excretory system.

In mature markets, mental health of pets is also receiving attention, as consumers become increasingly concerned about pet stress that they observe when leaving pets alone, especially following home seclusion during lockdowns. For example, in 2021, UK-based Scrumbles launched Nibbles Calming Dog Treats that include ingredients for mental and gut health.

As a sign that natural recipes are also being favoured, “free from” claims are gaining in popularity within pet food. As noted in Euromonitor International’s Products Claims and Positioning 2021, the top four claims such as grain free, no artificial preservatives, colours, and flavours are increasingly visible on product packaging. For instance, in the US, Made by Nacho released a grain-free product line in 2022.

Development of sustainability in packaging and ingredient selection

Pet owners are increasingly concerned about their impact on the planet, which creates growth potential for sustainable packaging and ingredients. According to Euromonitor International’s Voice of the Consumer: Lifestyle Survey, nearly 60% of pet owners try to reduce plastic usage, and 45% prefer sustainable packaging. Responding to the increasing demand for recyclable materials, producers are launching more recyclable packaging; for example, Mars is implementing packaging for its Sheba brand with recycled plastic in Europe for 2022.

Meanwhile, one third of pet owners are trying to reduce their own meat consumption. Amid rising flexitarianism among pet owners, alternative proteins, especially insect-based, are gaining ground in pet food. Identifying a growth opportunity, major players, including Mars, have launched plant-based products. Nestlé Purina has also entered insect-based products, launching Switzerland Beyond Nature’s Protein pet food in 2020, which contains both insect and plant protein.

Digitalisation of the shopping experience reinforced

During the pandemic, pet owners became increasingly used to the convenience of online shopping, while the offer has drastically expanded. The development of e-commerce stores and subscription services are contributing to the increasing personalisation of the offer, and enables consumers to enjoy the convenience of the generally smooth home delivery of large pack sizes and multipacks. Subscription services for pet food are also becoming more popular and embrace a wide range of brands, from niche specialised gourmet meals to mainstream brands, such as Royal Canin with its Club auto-renewal service.

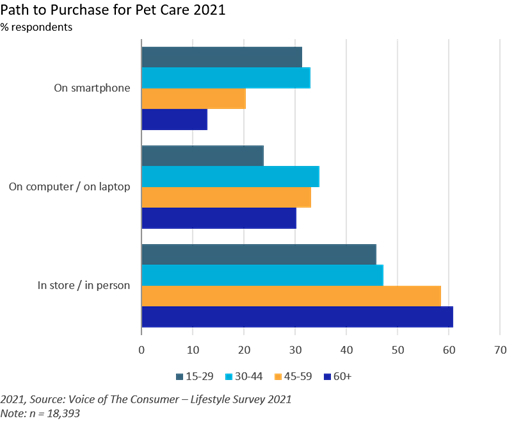

E-commerce is developing at the expense of store-based retailers, which are slowly losing share. According to Euromonitor International’s Voice of the Consumer; Lifestyle Survey 2021, almost one third of consumers aged under 45 years buy products for their pets via their smartphone, with this proportion increasing each year. The development of online platforms by international giants in pet food, such as Purina, contributes to the consumer shift towards e-commerce. Nevertheless, growth rates of e-commerce are generally slowing following the peak of unusually high growth due to the emergence of the pandemic, and as the channel matures in some markets such as North America.

Humanisation, premiumisation, health and wellness, sustainability, and digitalisation are the five key trends shaping global pet care and these are set to drive demand in the future. Consumers expect brands and retailers to meet their increasing demand for high-quality, human-like sustainable pet products and make the purchase path as convenient and fast as possible. In this regard, product positioning is gaining a crucial role in branding, consumer loyalty and higher margins.

[출처 : https://www.euromonitor.com/article/top-five-trends-in-pet-care ]