Bloomberg Intelligence’s Pet Economy Report finds that the global pet industry is set to expand rapidly over the next decade as pet owners spend more and pets live longer

New York, March 24, 2023 — The pet industry is poised to swell from $320 billion today to almost $500 billion by 2030, according to a new report from Bloomberg Intelligence (BI). The report finds that this growth is boosted by a growing pet population worldwide, as well as the premiumization of food and services resulting from the continued humanization of animal companions.

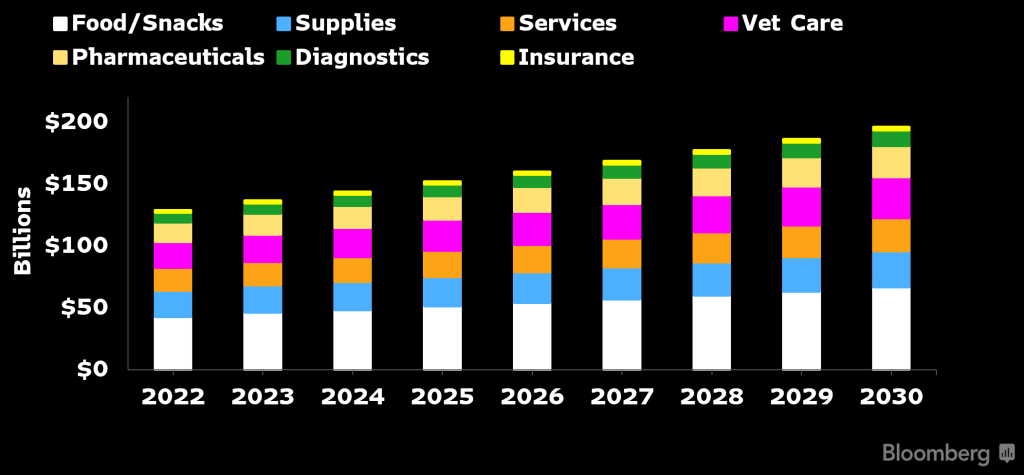

The analysis finds that the US is positioned to continue to remain the largest pet market, with sales approaching $200 billion by the end of the decade. This growth is driven by an increase in spending on pet-related healthcare — including veterinary care, diagnostics, and pharmaceuticals — that has created longer pet lifespans that require more expensive elderly care. This advancement and prioritization of elderly care may in turn lead to an increase of the US pet population by 13%. Other emerging markets may see outsized growth due to the increase in nuclear families in urban areas, single-person households, and a rise in per capita disposable income.

Alongside this longer pet lifespan comes a larger investment in increasingly complex drugs like monoclonal antibodies, which could make the pet pharmaceutical market top $25 billion by 2030. The analysis predicts that increased animal longevity and healthcare improvements might accelerate the use of preventive-care diagnostics as well, with the potential to become a $30 billion global market. Europe represents that largest growth opportunity with a total addressable market around $12 billion with just 8% penetration.

BI finds that positive trends in the largest pet industry category, alongside elevated levels of stickiness as pet owners continue to be reluctant to switch diets for their pets, may allow the global pet food market to top $135 billion by the end of the decade, an increase of 52% from current levels. This increased spending is expected to remain the largest expense for pet owners in the US, as food spending remains consistent even throughout economic downturns. The report also predicts that premium fresh frozen food, which only accounts for 1% of the market, may outpace other categories as awareness of health effects of food on pets continues to grow.

Ann-Hunter Van Kirk, Bloomberg Intelligence Senior Biopharmaceutical Analyst and co-author of the report said: “Increased pet nutrition is leading to longer pet lives around the world. With this comes an increased need for spending relating to expensive healthcare for aging pets, and we project that this spending on lasting health for pets will continue to swell over the next decade.”

Diana Rosero-Pena, Bloomberg Intelligence Consumer Staples Analyst and co-author of the report said: “We’re seeing a profound increase in consumer spending on pets and expect to see this continue through 2030. Consumers are willing to pay more for items for their pets, with the pet food market having the potential to grow more than 50% from current levels by the end of the decade.”

Figure 1: US Pet Industry May Approach $200 Billion by 2030

Source: Bloomberg Intelligence

With the push towards increasingly expensive pet care in the US being driven by younger consumers, newer means of acquiring pet goods continue to grow in popularity, with Bloomberg Intelligence estimating that US sales from e-commerce will double to nearly $60 billion by 2030. This would grow US e-commerce market share to around 30% compared to its existing 22%. This headway is thanks to digital native retailers’ investments to reduce friction that are increasingly popular among consumers.

BI’s Pet Economy research is available to Bloomberg Terminal subscribers, accessible via {BI <Go>}.

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of 400 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and 500 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.

Disclaimer

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2023 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.

[source : https://www.bloomberg.com/company/press/global-pet-industry-to-grow-to-500-billion-by-2030-bloomberg-intelligence-finds/]